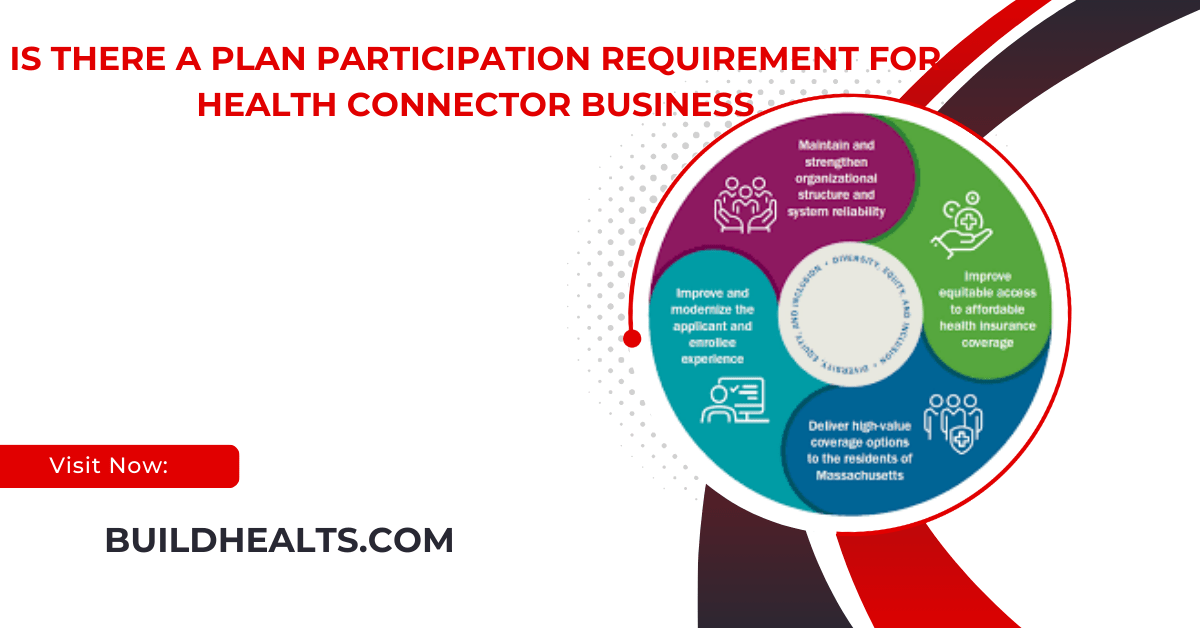

Well now, you’re asking about this here Health Connector Business and if there’s some kind of plan participation requirement for employers, huh? Well, let me tell ya, there sure is. If you’re runnin’ a business and you want to offer health insurance through the Health Connector for your employees, you gotta meet some requirements. Simple as that.

Now, the first thing you gotta know is that if you want to participate, you, as the employer, gotta offer a health plan to your workers. Ain’t no way around it. You can’t just sign up and hope for the best. Nope, your business gotta have a plan for your folks to sign up for, or else you’re outta luck.

But don’t go thinkin’ it’s all that complicated. There’s three main ways you can offer coverage to your workers, and that way they can find a plan that fits their needs the best. One of these ways is for businesses with 1 to 25 employees, where they automatically get enrolled in the ConnectWell program after buyin’ a health plan. Pretty handy, if you ask me!

Participation Requirements

If you want your business to be eligible for any of the Qualified Health Plans (QHPs) through the Health Connector, your employees gotta meet some minimum participation rules. That means you need a certain number of folks signing up for the plan, or else your business won’t be eligible to offer the insurance. Makes sense, don’t it? They want to make sure it’s worth the effort, both for you and the insurance folks.

For those businesses that might be struggling to meet these requirements, you might find it a little tougher to qualify, especially if your company doesn’t have a big group of employees. But don’t worry, there are options to help you meet those participation goals. You’ll just have to pay close attention to the details and make sure you’re doing it right.

What Happens if You Don’t Meet the Requirements?

Well, if you don’t manage to meet the participation requirements, then your business won’t be able to offer those health plans through the Health Connector. It’s that simple. And you don’t want to be stuck in that position because it could cause you all sorts of problems with keeping your workers happy and healthy. So, make sure you’re offering a plan that works and getting the right number of folks to sign up.

Another thing is, when you’re signing up for a plan, whether it’s dental or just regular health insurance, you gotta make sure it’s all compliant with the state and federal laws. That’s one less thing to worry about, at least. You don’t wanna be running afoul of the law while you’re trying to do right by your employees.

Flexibility for Small Businesses

Now, here’s where it gets a little bit more flexible. If you’re running a small business, say with less than 50 employees, the Health Connector for Business is gonna give you more than one option to offer to your employees. That means you can give them choices, and we all know people like choices, especially when it comes to their health insurance!

And I gotta tell ya, businesses can also get access to more benefits like dental plans. That’s right, you can offer a little more than just health coverage, and that’s mighty important for keeping your team happy and healthy. No one wants to just pay for doctor visits—they need their teeth looked at too, you know?

As for the employees themselves, they’ll have the chance to choose the plan that fits them best, depending on their situation. It’s all about finding what works for them, which in turn, helps your business keep a healthy workforce. After all, a sick employee can’t do much work, can they?

Eligibility for Small Group Plans

Now, there’s something important you gotta remember. Only those businesses that qualify are gonna be able to offer these small group health plans through the Health Connector. That means you gotta be eligible as an employer group before you can even get started. It’s your job to make sure that your business fits the criteria and that you’ve got all your ducks in a row. If you don’t, you won’t be able to offer those health benefits at all, and that’s a big deal in today’s world.

To make sure you’re on the right track, you’ll need to verify your eligibility and let the Health Connector know that everything is above board. They’ll want you to attest to that, which is just a fancy way of sayin’ “let us know you’re doing it right.” If you don’t get that part right, you’ll be stuck without those benefits.

Now, I know this all might sound like a lot of paperwork and rules, but it’s just the way things work. Health insurance is a big deal, and these folks need to make sure that everyone’s playing by the same rules. It might be a little bit of a hassle at first, but once you get the hang of it, you’ll see that offering health coverage to your employees is a big ol’ win for everyone.

So, in conclusion, yes, there is a plan participation requirement for businesses looking to offer health insurance through the Health Connector. You gotta offer a health plan, meet the minimum participation rules, and make sure everything is compliant with the laws. If you do all that, your business can offer health coverage to your employees and keep everyone happier and healthier. And remember, it’s always worth checking the details and getting everything lined up right so you don’t miss out on the benefits.

Tags:[Health Connector, Business Health Insurance, Plan Participation, Qualified Health Plans, Health Insurance for Employers, Small Business Benefits, Dental Plans, Employer Eligibility, Health Connector for Business, Employee Health Coverage]