[Body]

Alright, let’s gab about these credit unions for your business, ya know, the places where you stash your hard-earned cash. I ain’t no fancy city slicker, but I know a thing or two about makin’ a dollar stretch, so listen up.

First off, what’s a credit union anyway? Well, it ain’t like them bigshot banks, that’s for sure. Them banks, they’re all about makin’ money for themselves, lining their pockets with your sweat. Credit unions, though, they’re different. They’re like a club, a group of folks comin’ together to help each other out. You put your money in, and they use it to give loans to other folks in the group. And the best part? Anythin’ extra they make, they give it back to you, the members. Ain’t that somethin’?

Now, findin’ the best credit union for your business, well, that’s like findin’ a good hen that lays plenty of eggs. You gotta look around a bit. Some folks say them big ol’ credit unions like Navy Federal Credit Union are good, especially if you were in the army or somethin’. They got lots of branches and all, but sometimes they’re so big, they forget about the little guy.

Then you got these other ones, like State Employees’ Credit Union. Heard they’re pretty good if you work for the government. And there’s PenFed Credit Union too. Lots of folks like ’em.

But me, I like things simple. I heard tell about Digital Federal Credit Union bein’ good for that. Nothin’ fancy, just straight-up good service. That’s what I like. No fuss, no muss.

- America First Credit Union is another one folks talk about. They say they’re good for small businesses, helpin’ ’em grow and all. That sounds alright to me.

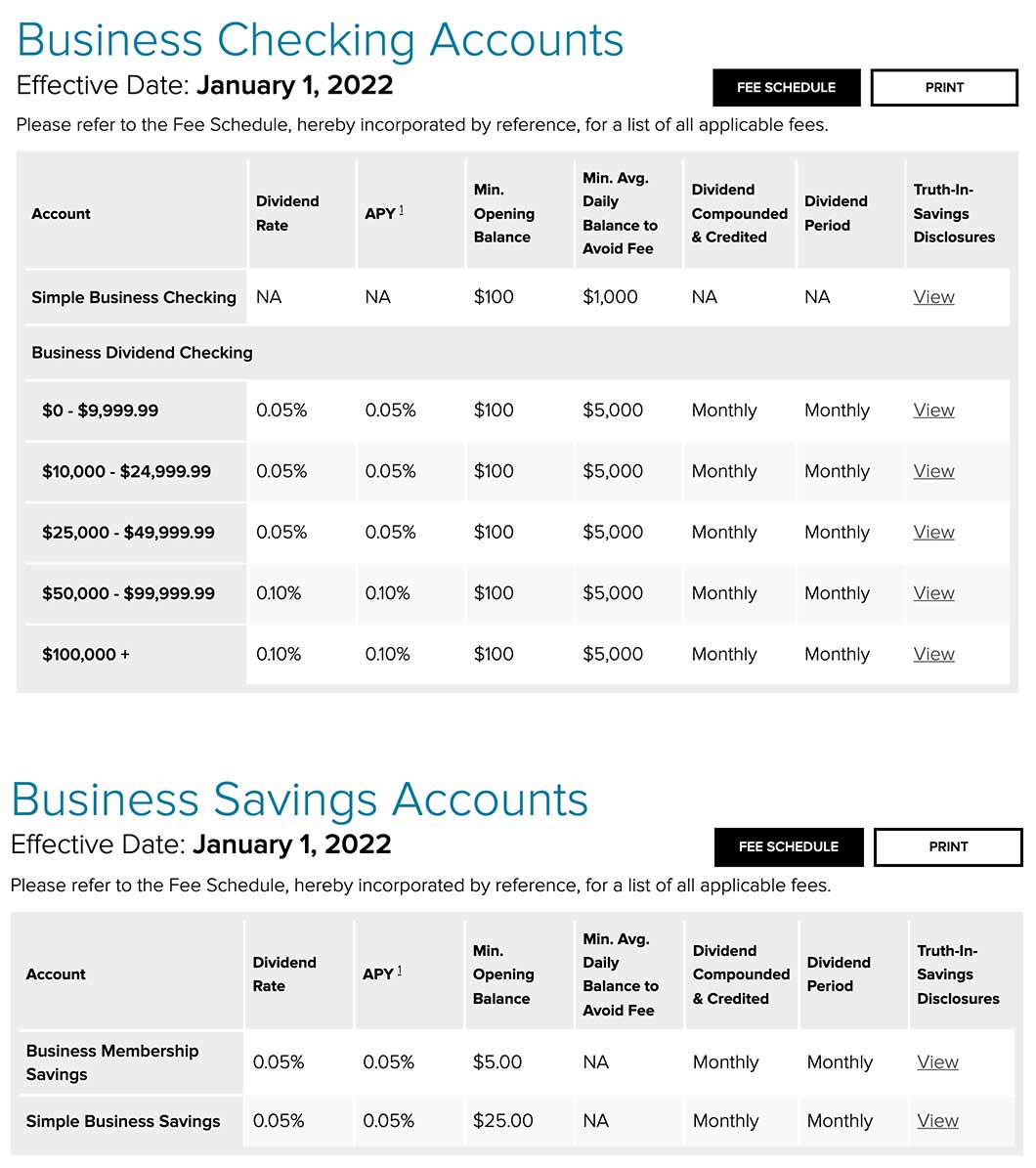

- Now, how do you pick the right one? Well, first off, you gotta see what kind of accounts they got. You need a business account, right? Make sure it ain’t gonna cost you an arm and a leg in fees. Them fees, they can eat you alive if you ain’t careful.

And don’t forget about customer service. You want folks who are gonna treat you right, not like some dumb cluck who don’t know nothin’. If you call ’em up, they should answer the phone and be willin’ to help you out. None of that automated mess, ya hear?

Another thing to look at is the rates. If you’re gonna borrow money, you want a good rate, somethin’ that won’t break the bank. And if you’re gonna keep your money there, you want a decent interest rate too. Every little bit helps, ya know?

Some folks say you should look at a whole bunch of credit unions before you make up your mind. I heard tell of some folks comparin’ over 50 of ’em! That’s a lot of lookin’, but I guess it pays off in the end.

And don’t forget about them regional banks neither. They ain’t credit unions, but some of ’em are pretty good for small businesses. Places like Regions, Citizens, PNC, Commerce, and Trust. They got branches all over, which is handy.

So, there you have it. My two cents on findin’ the best credit union for your business. Just remember, do your homework, don’t be afraid to ask questions, and go with your gut. You’ll find the right one, I reckon.

In conclusion, finding a good credit union is like finding a good friend – someone you can trust and rely on. So take your time, do your research, and choose wisely. Your business will thank you for it.

And remember, don’t let those fancy city slickers fool ya. A good deal is a good deal, no matter where you find it.

Tags: [credit unions, business banking, small business, Navy Federal Credit Union, State Employees’ Credit Union, PenFed Credit Union, Digital Federal Credit Union, America First Credit Union, regional banks, business accounts, customer service, interest rates, fees]