So, you’ve hung out your shingle, you’re your own boss, king or queen of your therapy castle. Feels good, right? Yeah, until you remember that little thing called health insurance. When I first went fully private, that hit me like a ton of bricks. My old employer plan? Gone. Poof. Suddenly, I was on my own, and let me tell you, it was a bit of a scramble.

Figuring Out Where to Even Start

My first move, like most folks, was the internet. I typed in “health insurance for self-employed therapists” or something equally desperate. And wow. What a rabbit hole. So many options, so many acronyms, so much jargon. It felt like I needed a PhD just to understand the basics. I remember staring at my screen, coffee getting cold, thinking, “How does anyone figure this out?” It was overwhelming, to say the least.

I quickly realized just clicking around wasn’t going to cut it. I was getting nowhere fast, just more confused.

Talking to Real People – A Game Changer

After a few days of banging my head against the digital wall, I decided to do something radical: talk to other therapists. I reached out to colleagues who were already in private practice. This was probably the best thing I did. Some were in the same boat, still figuring it out. Others had systems, or at least experiences to share.

Here’s what I gathered from those chats:

- Some were on their spouse’s plan. Lucky ducks. Not an option for me at the time.

- Some went through the healthcare marketplace.

- A few had found private plans, sometimes through brokers.

- Others mentioned professional association plans, though those seemed a bit hit-or-miss depending on the state and the association.

Hearing their stories, their frustrations, and their solutions made me feel less alone. It also gave me some actual leads to chase down, instead of just staring at a million web pages.

Getting Down to Brass Tacks: What Did I Actually Need?

Okay, so armed with some direction, I started to think about what I actually needed. It’s easy to get swayed by fancy plans, but I had to be realistic about my budget and my health. I made a list:

- Decent coverage: I didn’t want something that would leave me bankrupt if I actually got sick.

- My doctors: I wanted to make sure my current doctors were in-network, if possible. Big one for me.

- Affordable premium: Obvious, right? But “affordable” is subjective. I had to figure out what that meant for my new business budget.

- Understandable terms: I wanted to at least grasp what I was signing up for. Less fine print, more plain English.

This list helped me filter out a lot of the noise. I wasn’t just looking for “health insurance”; I was looking for something that fit my specific situation as a solo therapist.

The Nitty-Gritty: Comparing and Contrasting

So then came the actual work. I looked at the marketplace options. I got quotes from a couple of independent brokers. I even checked out a few of those association plans, though none of them really panned out for me personally – either the coverage wasn’t great, or the cost was higher than I expected for what you got.

Brokers were helpful, I gotta say. A good one can sort of cut through the crap for you. They know the plans, they know the local market. The first one I talked to wasn’t a great fit, felt a bit like they were pushing me. But the second one really listened. That made a difference.

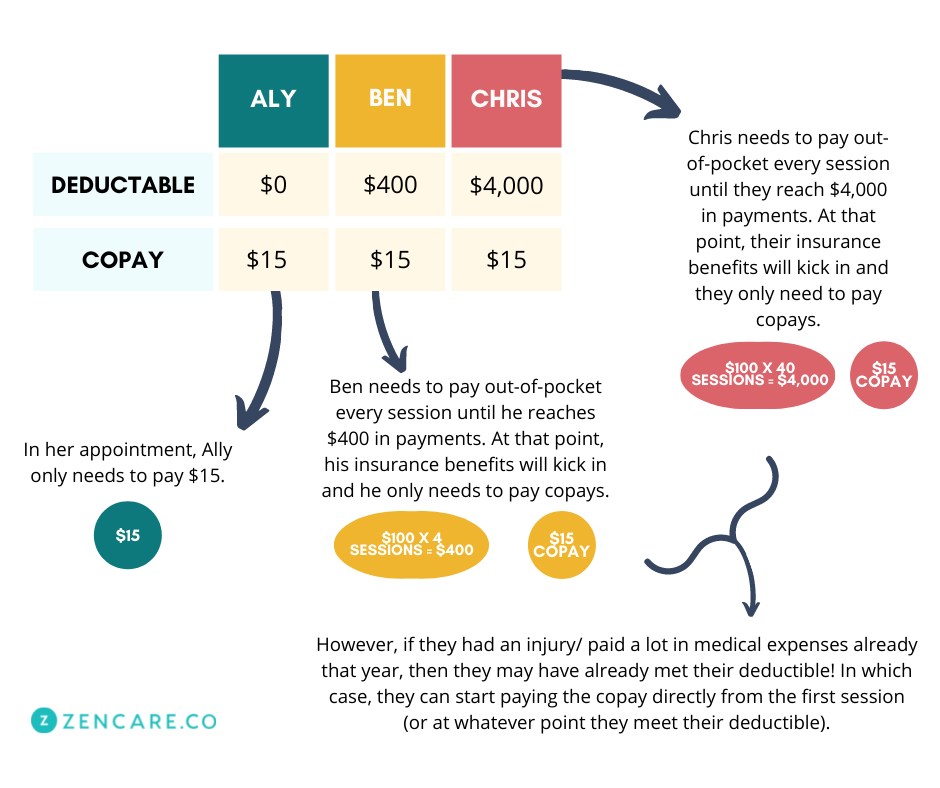

It was a lot of comparing deductibles, copays, out-of-pocket maximums. My kitchen table was covered in printouts and scribbled notes for a while there. It felt like doing taxes, but for my health.

Making the Call and What I Learned

In the end, I landed on a plan through the marketplace. It wasn’t perfect, no plan ever is, right? But it hit most of my key points: my main doctor was in-network, the premium was manageable (especially with the tax credits available to self-employed folks, don’t forget to look into those!), and the coverage felt solid enough for my peace of mind.

The application process itself was… an online form. You know how those go. Gather your documents, answer a million questions, click submit, and hope for the best. It actually went smoother than I thought it would, thankfully.

Looking back, the biggest thing was just starting and not getting paralyzed by all the choices. Breaking it down, talking to people, and focusing on what I needed, not what some website said was the “best” plan in the universe. It’s a pain, no doubt about it, especially when you’re trying to build your practice. But having that insurance card in my wallet? That’s one less thing to worry about, and that’s worth a lot.

So, if you’re in that boat, take a deep breath. It’s doable. Just take it one step at a time. And definitely talk to your colleagues!