Well now, if you’re lookin’ for a good ol’ reliable auto insurance company, you came to the right place! Nowadays, it’s harder than ever to find a good deal on car insurance. I’ve been around long enough to know that it ain’t like it used to be. Back in the day, we didn’t worry too much about all these fancy plans and coverages. But now, with cars costing so much and the price of insurance shootin’ up like a rocket, we gotta be more careful, you know?

Why You Need Car Insurance

You might be thinkin’, “Why do I even need car insurance? I ain’t gonna crash my car!” Well, honey, nobody plans on accidents, but they happen. Whether it’s a fender-bender or somethin’ more serious, insurance is gonna save your bacon. You don’t want to end up stuck with a pile of medical bills or having to fix your car out of your own pocket. You gotta have insurance, plain and simple.

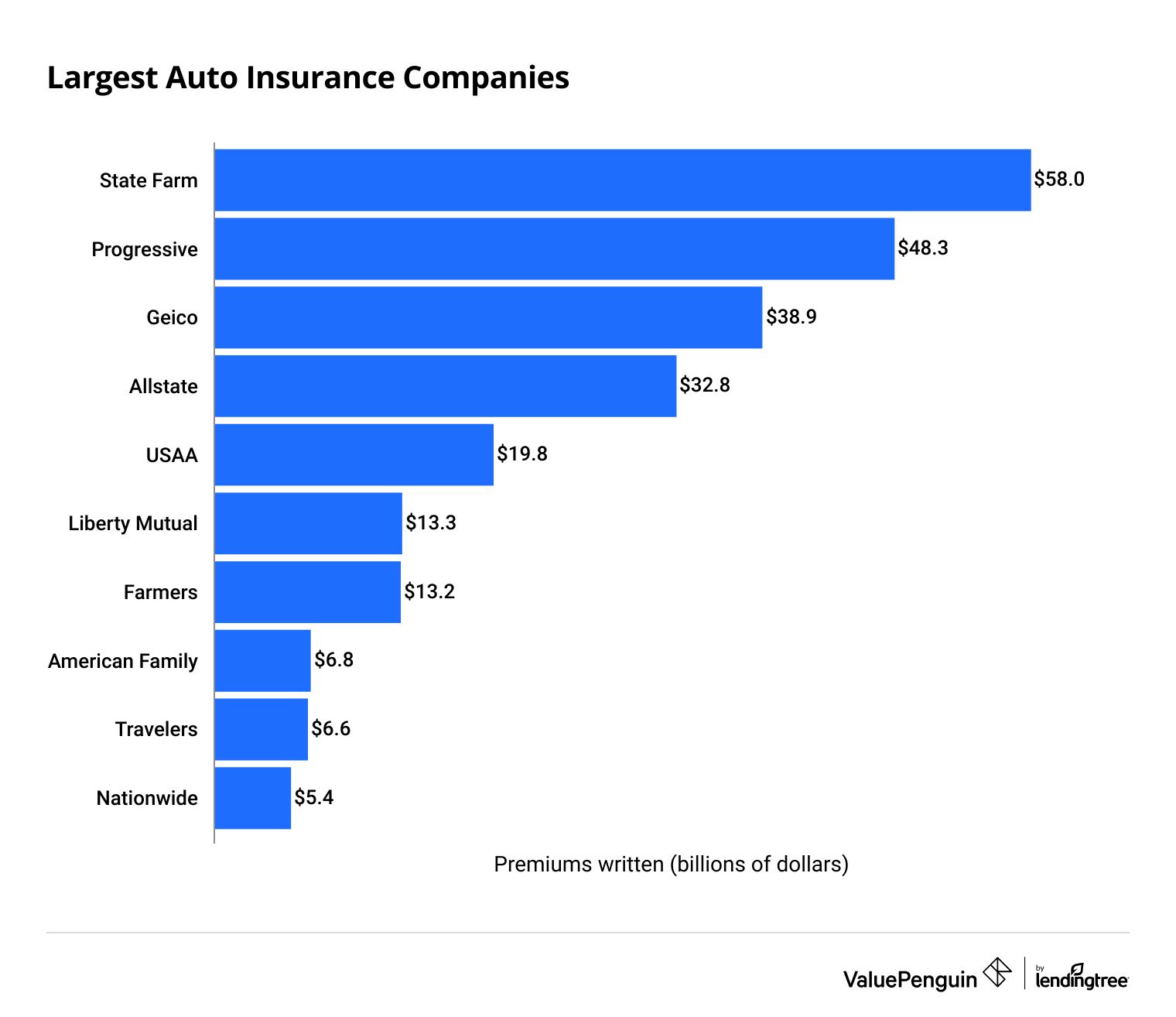

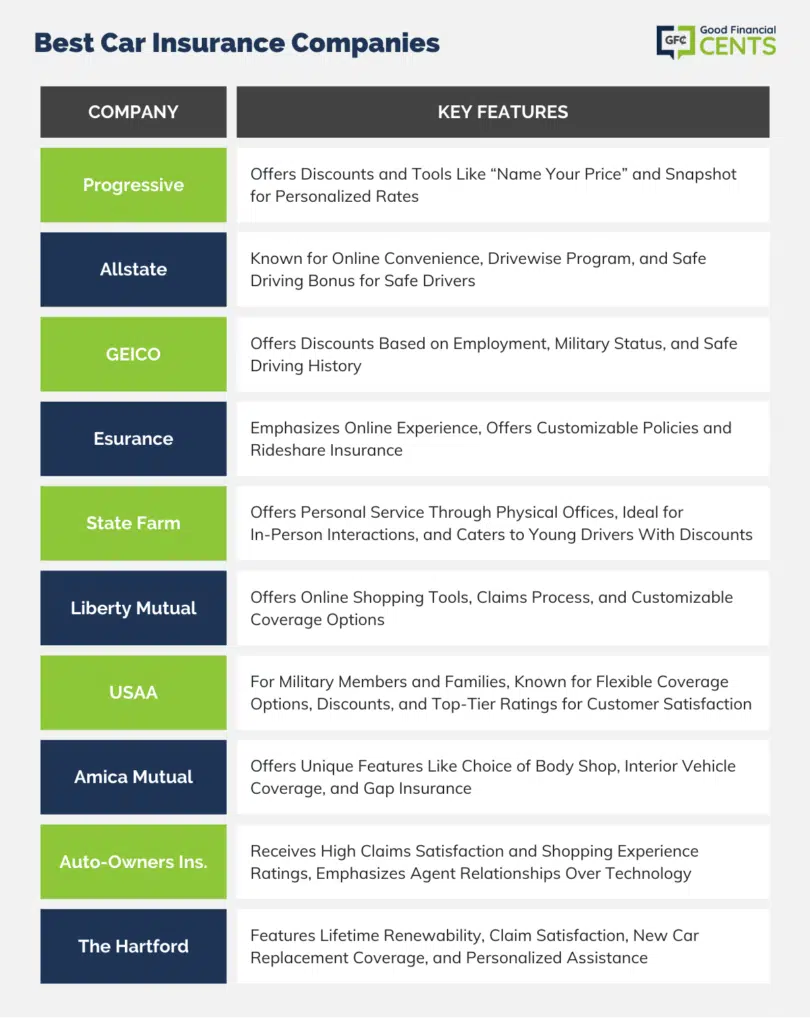

Top Auto Insurance Companies Around the World

Now, let’s talk about the best auto insurance companies. There’s plenty of them out there, but you gotta know who’s worth your time and money. I went and looked into it and found out which ones are top-rated for good coverage and fair prices.

- Nationwide: This company came out on top in a lot of surveys, and for good reason. They’ve got a lot of different options for you, whether you need just the basics or something more fancy. If you want a reliable and trusted company, Nationwide is where you should start.

- Germania Insurance: Now, if you’re down in Texas, you gotta check out Germania. They’ve been around for decades and Texans trust ‘em. They know what people in Texas need when it comes to car insurance, so it’s definitely worth lookin’ into if you’re down that way.

- Allstate: This one is another big name you can’t miss. They’ve been in the business a long time, and they offer a lot of different plans, including stuff like roadside assistance, which can really come in handy.

- State Farm: Now, State Farm is another well-known name in the insurance world. They offer a wide range of options, and their customer service gets pretty good marks. Plus, you can get discounts if you bundle other types of insurance with your car insurance.

What to Look for in an Auto Insurance Policy

When you’re lookin’ at car insurance, there are a few things you gotta think about. First off, you want to make sure you’re gettin’ enough coverage. That means you want a policy that’ll cover you in case something big happens, like a wreck or a lawsuit. You don’t want to be stuck payin’ for everything yourself.

- Liability Coverage: This is the stuff that’ll pay for the damage you cause to other people and their property. It’s a must-have, especially if you’re the one at fault in an accident.

- Collision Coverage: This’ll cover the cost of repairing your car if you get into a wreck, no matter who’s fault it is.

- Comprehensive Coverage: This one covers you for stuff like theft, vandalism, or damage from a storm. You might not think it’s necessary, but it can save your skin if something unexpected happens.

How to Save on Auto Insurance

Now, if you’re like me, you don’t want to spend more money than you have to. So, here are a few tips to help you save some cash on your insurance:

- Shop Around: Don’t just settle for the first quote you get. You’ve got to compare prices from different companies to make sure you’re gettin’ the best deal.

- Bundle Policies: If you’ve got other types of insurance, like home insurance, bundle ‘em up with your car insurance. A lot of companies will give you a discount for that.

- Raise Your Deductible: If you can afford to pay a little more out-of-pocket if something happens, raise your deductible. That’ll lower your monthly premium.

- Drive Safely: Some companies offer discounts for safe driving, so if you’ve got a clean driving record, be sure to let them know!

What About International Coverage?

Now, some folks might be wonderin’, “What if I’m gonna drive my car outta the country?” Well, most U.S. car insurance policies only cover you in the U.S. and Canada. So if you’re planning to drive in other places, you might need to get a separate policy. It’s always best to check with your insurance company to see what kind of coverage they offer if you’re goin’ abroad.

Conclusion

Well, there you have it, dear. A quick rundown on the best auto insurance companies and what you need to look for when gettin’ yourself covered. Remember, you gotta protect yourself and your car. It’s always better to have that peace of mind, just in case something unexpected happens. So, shop around, find the right policy for you, and make sure you’re covered!

Tags:[auto insurance, car insurance, best auto insurance companies, Nationwide, Germania Insurance, State Farm, insurance coverage, auto insurance tips, save on car insurance]